A generous application of conservative practices needs to be the next steps toward curtailing the City of Harvey's dire pension crisis, a Glen Ellyn Republican running for the state House said during a recent interview.

"401(k) all new employees," Gordon "Jay" Kinzler, a surgeon and U.S. Army Reserve colonel running for Illinois' 46th District State House seat, told the DuPage Policy Journal. "Consider benefit adjustments and Consumer Price Index (CPI) increases. Look into abuse of full pension benefits to spouses when an 80-year-old fire chief marries a 26-year-old and she gets a 100 percent pension benefit of the chief's for her lifetime."

Harvey's current situation amounts to an "abuse of taxpayer and other pension beneficiaries in the system," Kinzler said. He also warned, in agreement with a report issued last month, that Harvey probably is only the first in a long line of pension funds to enter a heightened phase of the crisis in Illinois.

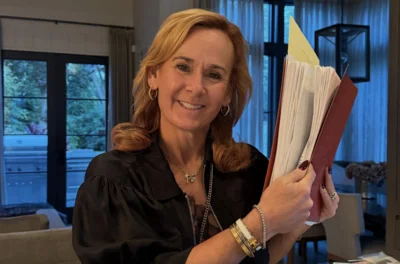

Republican Illinois 46th House District Candidate Gordon "Jay" Kinzler

"This is just one example," Kinzler said. "It will happen in other places in Illinois soon."

Kinzler, who won the primary in March by taking almost 80 percent of the vote from rival Roger Orozco, is running for the state House seat currently held by Rep. Deb Conroy (D-Villa Park). The district includes all or part of Glendale Heights, Carol Stream, Addison and Villa Park.

Financial trouble in Harvey has generally been brewing for years but the situation became especially dire last summer when the First District Appellate Court of Illinois ordered Harvey to bolster its firefighter pension fund - then only 22 percent funded - by raising property taxes.

In April, the insolvent suburban city south of Chicago laid off 40 in Harvey's police and fire departments to help find the more than $1 million due in its police pension fund. The layoffs represented about a quarter of Harvey's police union members, 40 percent of the city's union-represented firefighters and 55 percent of "non-sworn" police personnel, according to a Chicago Tribune story that quoted union officials.

South Cook News previously reported that Harvey taxpayers have paid out almost $25 million into 42 retired firefighters' pension benefits while the retirees have contributed about $1.14 million to the retirement fund. More than half of those retirees contributed nothing to their pension fund, according to the South Cook News story.

It isn't difficult to understand why Harvey's financial problems have been able to fester, Kinzler said.

"Poor leadership, too generous of pension benefits and outdated pension rules - particularly a 3 percent raise per year - far outpacing CPI and what taxpayers are able to afford," he said.

Harvey isn't alone in its pension debt crisis in Illinois. A Wirepoints special report issued at about the same time as the layoffs said almost 400 other pension funds in the state could trigger garnishment,

"You’d be mistaken to think Harvey, Illinois has a unique pension crisis," the Wirepoints report said. "It may be the first, and its problems may be the most severe, but the reality is the mess is everywhere, from East St. Louis to Rockford and from Quincy to Danville. A review of Illinois Department of Insurance pension data shows that Harvey could be just the start of a flood of garnishments across the state."

Alerts Sign-up

Alerts Sign-up