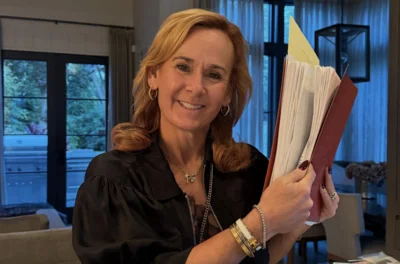

Illinois State House Rep. Jeanne Ives (R-Wheaton)

Illinois State House Rep. Jeanne Ives (R-Wheaton)

Rep. Jeanne Ives (R-Wheaton) thinks the new Comprehensive Annual Financial Report showing that Illinois lost $9.9 billion in net worth in 2017 shows just how little elected officials are doing to turn around the state after years of gross mismanagement.

“Illinois elected officials are burying their heads in the sand and ignoring the consequences of decades of mismanagement,” she told the DuPage Policy Journal. “While states cannot go bankrupt, there is no feasible way for Illinois to repay this debt. Compared to other states, it is obvious our politicians have made promises that even other more liberal states never made on the backs of taxpayers.”

Several media outlets have reported the losses dropped the state’s “total primary government net position” to negative $137 billion. The annual figures are composed by measuring the net worth of assets minus liabilities.

Estimates are the $9.9 billion figure equates to approximately a quarter of the state’s total revenue for the year, which was about $38 billion.

“Taxpayers are facing tax increases at the local level for municipal pensions and increased school costs – both of which are outrageous, especially after the 32 percent income tax increase last July,” Ives, who finished just 3 percentage points behind Gov. Bruce Rauner in the Republican primary, said. “Local governments need to start demanding reform in Springfield to protect their withering tax base.”

All the losses aren’t just restricted to the state, with figures showing over the last decade the city of Chicago, Cook County and the Chicago Public Schools have all suffered steep losses.

“The state needs to immediately stop digging the pension hole by first having all new hires placed into a 401(k)-style system,” Ives said. “State leaders also need to seek restructuring of the debt and pension obligations as there is no feasible way they can be paid.”

As it is, data shows Illinois is easily outpacing other states in terms of its negative net position, with a recently booming stock market having little impact in turning the tide. Wirepoints has reported further research concludes the bulk of the state’s losses over the last decade derive from still bubbling unfunded annuity liabilities. Even with markets dramatically rising in 2017 and the state’s pensions earning an unusually high 15 percent, pension liabilities stayed basically flat and the state remained heavily mired in increasing debt.

“Balanced budgets always help, but Illinois has not enforced its own constitutional requirement for a balanced budget since 2001, so until the courts step in and enforce the constitutional requirement, the overspending will continue,” Ives said.

Alerts Sign-up

Alerts Sign-up