City of Warrenville City Council met March 18

Here are the minutes provided by the council:

FY 2024 BUDGET WORKSHOP

A. CALL TO ORDER

Mayor Brummel called the meeting to order at 9:00 a.m.

B. ROLL CALL

Present: Mayor David Brummel, and Aldermen: Stuart Aschauer, Clare Barry, Kathryn Davolos, Leah Goodman, Jeff Krischel, Craig Kruckenberg, John Lockett and Bill Weidner

Absent: None

Also Present: City Administrator Cristina White, Assistant City Administrator Alma Morgan, Finance Director Kevin Dahlstrand, Public Works Director Phil Kuchler, Community and Economic Development Director Ron Mentzer, Assistant Community Development Director Consuelo Arguilles, Police Chief Sam Bonilla, Assistant Community Development Director Consuelo Arguilles, Capital Maintenance Superintendent Jamie Clark, Utility Maintenance Superintendent John Satter, Senior Accountant Faranaz Kavina, City Clerk Julie Clark, and Executive Assistant / Deputy City Clerk Dawn Grivetti.

Also Absent: None

C. FISCAL YEAR 2024 BUDGET REVIEW AND DISCUSSION

1. Introductory comments by Mayor Brummel

Mayor Brummel welcomed all those in attendance for coming to the FY 2024 Budget Workshop. He commented on the remarkable job staff has done in preparing the budget for review, and thanked staff for the work that they do throughout the year.

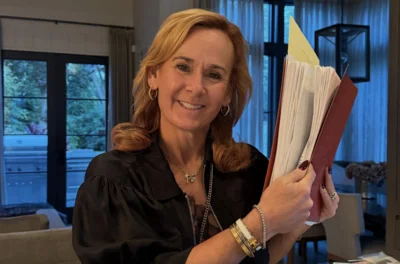

City Administrator (CA) White welcomed everyone and thanked all for attending. She then introduced Finance Director (FD) Dahlstrand who began the presentation.

2. Discussion of FY 2024 Budget major funds and decision packages

FD Dahlstrand began by providing an overview of the major funds in the proposed FY 2024 Budget.

a) General Fund Revenues

FD Dahlstrand stated staff is projecting a surplus of just over $302,000 in the General Fund (GF) for the end of FY 2023, and a deficit of nearly $2 million for the proposed FY 2024 Budget. This is largely a result of several one-time expenditures that were either planned or delayed from previous fiscal years. Additionally, staff tends to budget revenues conservatively and over-estimate expenses.

Revenue Projections

FD Dahlstrand described the projected FY 2024 GF revenues from State Shared Sales Tax, Home Rule Sales Tax, Food and Beverage Tax, State Income Tax, and Use Tax. He compared these revenues to the FY 2023 projected revenues and the FY 2019 actual revenues as the last complete fiscal year before COVID-19. He noted that of these taxes, only the Food and Beverage Tax is projected to be less than 100% of FY 2019 revenues. Going forward, the City should be able to compare each fiscal year to its previous year. Overall, despite the near full recovery of all other taxes, a decrease in GF revenue of approximately 2.36% from FY 2023 is projected for FY 2024.

Mayor Brummel described the issues municipalities are having with the State withholding a portion of the local share of the State income tax revenue known as the Local Government Distributive Fund (LGDF). He encouraged elected officials to contact State legislators to return the LGDF to a full 10%.

General Fund Expenses

When describing the General Fund proposed expenditures, FD Dahlstrand reported that personnel expenses is the largest expense category in the General Fund. CA White added that, like most municipalities, the City provides many services to the community, which require people to perform those services, therefore personnel will always be the City’s largest expense.

Decision Packages

CA White went on to describe the Administration Department’s decision packages, which included a citywide facilities and space needs study and a strategic planning facilitator to assist the City with updates to the Strategic Plan.

Community and Economic Development Director (CEDD) Mentzer described the Community Development Department’s decision packages, including the implementation of a rental registration and inspection program, Route 59 multi-use path, and a special census.

There was discussion regarding the need for a special census. FD Dahlstrand stated the City receives approximately $240 per year in per capita income. CEDD Mentzer indicated staff is estimating a special census could capture an additional 2,000 residents since the 2020 Census was conducted. The increased population could result in a significant amount of increased revenue for the City. CEDD Mentzer added that the increased revenue could cover the cost of the special census in one year depending on the outcome.

Police Chief Bonilla described the Police Department’s decision package to purchase a utility terrain vehicle (UTV) for the purpose of providing public safety during emergency situations in areas of the community that are inaccessible to standard sized vehicles. He added that it could also be useful for traffic control and enforcement and for community relations.

There was discussion regarding the general need for such a vehicle and the coordination with other local jurisdictions regarding the City’s ability to respond in an emergency situation with such a vehicle. Chief Bonilla stated the City has a general obligation to enter adjacent jurisdictions when responding to any emergency situation, and a vehicle of this nature would benefit the City’s response. Chief Bonilla added that a UTV allows the City to be better prepared in a time of emergency.

There was further discussion regarding research into a hybrid option for the UTV, or if staff considered applying for grants or sponsorships for such a vehicle. Several aldermen questioned the need for a UTV at this time, and were concerned about the cost and future impact on the Capital Maintenance and Replacement Plan (CMRP).

Public Works Director (PWD) Kuchler described the Public Works Department’s decision packages, including the Batavia Road and Route 59 drainage improvements, consultation services for the Enterprise Resource Program replacement, and the keyless entry upgrades to all municipal buildings.

There was discussion regarding the proposed improvements to the open storm sewer drainage system and the future health and safety benefits it will provide the City.

General Fund Personnel Expenditures and Fund Balance

CA White stated that personnel amounts to 67% of all General Fund expenditures, and the FY 2024 Budget does not include any additional full-time positions, however, there will be a need for new part-time positions in the Police Department. CA White discussed the challenges the City has faced in filling various positions and remaining competitive in the employment market. She also talked about the unknown impact the newly signed Employee Leave For All Act may have on the budget.

The actual and projected assigned, unassigned, and non-spendable amounts of the General Fund Balance were also discussed. FD Dahlstrand stated that by the end of FY 2023, staff is projecting the unassigned fund balance to be at 38%, which is well above the Council-approved reserve of 25%.

Mayor Brummel added that the TIF Fund repayments are accelerating and functioning as planned.

b) Capital Maintenance and Replacement

FD Dahlstrand addressed the proposed revenue and expenses of the Capital Maintenance and Replacement (CMR) Fund. He indicated the expenses proposed for FY 2024 are higher than the City normally spends in one year, and is due in part to FY 2023 budgeted expenses that will carry over into FY 2024. He reminded the Council of the delayed purchase of some vehicles due to supply chain issues.

CMR Revenue changes

FD Dahlstrand addressed the transfer of funds into the CMR Fund from the Road and Bridge Fund. Historically, the transfer amount was $37,000. After further discussion, the Long Range Financial Planning workgroup recommended all of the Road and Bridge property tax revenue be transferred from the General Fund into the CMR Fund.

FD Dahlstrand continued to discuss other revenues associated with the Fund, and noted that FY 2023 projected revenues are still below pre-pandemic rates for most of the associated taxes, except the natural gas and local motor fuel taxes, which are performing quite well. He added that, starting in FY 2024, the Long Range Financial Planning workgroup recommended the State cannabis revenue be added to the CMR Fund as an additional revenue source, as well as video gaming fees. If a cannabis dispensary is built within the City, the revenue generated will also be added to the CMR Fund.

CMR Fund Highlights for FY24

FD Dahlstrand discussed the police replacement vehicles added to the FY 2024 Budget that were not purchased in FY 2023, other projects that were delayed from previous budget years, as well as road projects and other vehicle purchases and payments planned for FY 2024.

c) Motor Fuel Tax Fund

FD Dahlstrand discussed the proposed revenues and expenses for the Motor Fuel Tax Fund, and noted that the projected revenue total for FY 2023 includes the final payment received from the Rebuild Illinois program. These funds are planned to be used on the Mack Road project.

Decision Package – Mack Rd Bridge & Path Construction

CEDD Mentzer addressed the Mack Road Bridge and Path construction decision package included in the Fund, and PWD Kuchler addressed other projects included in the Fund as well. PWD Kuchler noted the restrictions to using MFT funds on projects, and FD Dahlstrand added that the City recently completed an MFT Fund audit of FY 2021 with positive results. There was further discussion regarding the ability of staff to obtain federal and state grants to fund most of the City’s construction projects.

d) Hotel Tax Fund

Reports indicate the City’s Hotel Tax revenue is projected to be only 85% of where it was at the end of FY 2019. FY Dahlstrand stated it is unlikely to recover to its previous revenue levels, and indicated this is typical for the industry at this time. FD Dahlstrand noted that in FY 2023, ARPA funding was directed to this fund as well as to the Water and Sewer Fund.

Grants and other expenditures were discussed, and Mayor Brummel stated that the investment the City puts into funding grants and other projects is recognized and well received by the community and the DuPage Convention and Visitors Bureau.

FD Dahlstrand stated a recommendation from the Long Range Financial Planning workgroup was to delay the final payback of funds into the Hotel Tax Fund from the TIF Funds until FY 2025.

e) Water and Sewer Fund

CA White stated that the Water and Sewer Fund has been the most challenging fund to address during the budgeting process. She reminded officials that the City utilizes the services of the City of Naperville to treat waste water, and Naperville is planning major capital improvements to their system. Staff has estimated that the City’s portion of the improvement cost is approximately 9% of the total. Initially, the City’s portion of the Naperville improvements was anticipated to cost $5 million, however, they are now estimated to cost the City over $15 million, plus borrowing costs and fees. As this increase was unanticipated, the Enterprise Maintenance and Replacement Plan (EMRP) workgroup has been working on adjusting City sewer rates to accommodate this increase.

Mayor Brummel indicated that the City of Naperville has been helpful in allowing the City extended time to pay our portion of the project. He added that no other feasible options exist for the City to manage waste water.

∙ Water and sewer rate recommendations

FD Dahlstrand stated Water and Sewer revenues for FY 2024 include a 5% water rate increase and 10% sewer rate increase as well as a new Naperville Treatment Plant Upgrade fee. CA White reminded the Council that there were several years when the City did not increase rates, and the City has to catch up with rates to keep up with regular maintenance and operations fees. Even after the rate increases, the City is still on the low end of the list of municipalities within DuPage County for water rates. PWD Kuchler clarified that the proposed water and sewer rate increases are recommended for each of the next three years. Staff will continue to annually review the health of the fund and the Enterprise Maintenance and Replacement Plan.

Mayor Brummel reminded residents that the City’s water rates are significantly lower than the DuPage Water Commission, even after residents soften water to their preference. There was further discussion regarding the effect of increased rates on homeowners.

∙ Naperville Surcharge

FD Dahlstrand indicated that preliminary estimates provided by the City of Naperville have resulted in a proposed Naperville Treatment Plant Fee for City sewer customers. Staff indicated the proposed fee may change as the associated project planning is finalized and construction begins.

There was some discussion regarding possible options to assist residents who cannot afford the increase. CA White discussed the long-term nature of the Naperville improvement project and stated that it will include multiple phases over many years, and the fee imposed may change every year accordingly. She added that, with the help of Naperville, the City of Warrenville will be able to pay its portion over a longer period of time, even beyond the project timeline, which helps to ease the burden on customers.

It was noted that the EMRP workgroup considered many options for assessing fees, and settled on the most equitable way, which is by usage.

Mayor Brummel asked what percentage of the community is connected to water and sewer and thereby affected by these rates. FD Dahlstrand replied that staff will look into that, and report back at a later date.

Mayor Brummel reminded the Council that increased populations will help pay for these improvements and keep individual costs reduced.

Water & Sewer Fund Expenditures

FD Dahlstrand addressed the Water and Sewer Fund expenditures. Ald. Davolos asked for a benefit analysis of the Infiltration and Inflow (I/I) Reduction Program. PWD Kuchler indicated progress on the program can be assessed during FY 2025 when there will be limited work done on the project. At that time, a flow monitoring analysis can be done.

Decision Packages

The Water and Sewer Fund decision packages were discussed, including the proposed upgrade to the City’s water system and sewer capacity modeling application. This system creates global information system (GIS) maps of the utility infrastructure to improve modeling and sewer capacity calculations.

PWD Kuchler discussed the benefits of the new, larger capacity water tower in the southwest district of the City. He indicated the new tower is a necessity in order to balance out the capacity of water throughout the community. The southwest district was lacking capacity, and the new tower will provide more capacity and balance to the system.

f) TIF #3 Fund

FD Dahlstrand addressed the projected revenues and expenses in TIF #3. CEDD Mentzer discussed the decision packages within the fund budget, and notably, the costs related to remediation activities on the former Citgo property (Old Town Redevelopment Site #2). He indicated that some expenses may carry over into the next fiscal year. He further discussed the possibility that some of the loan revenue may be waived from the State as remediation is complete.

Fund Balances

Actual and projected fund balances were presented as well as the projected payback schedule of the interfund loan.

g) TIF #4 Fund

FD Dahlstrand addressed the projected revenues and expenses in TIF #4. Proposed expenses include contributions toward the Well #13, Tower and Iron Filtration Project, the Naperville Treatment Plant, and bond interest. He indicated that the water and iron filtration facility will remove iron from water distributed throughout the City, and not just in the southwest district.

CEDD Mentzer discussed the decision package for a City monument sign located on Route 59, consistent with existing monument signs throughout the City.

Fund Balances

Projected fund balances were discussed as well as the projected payback schedule of the interfund loan. FD Dahlstrand noted that the projected fund balance for April 30, 2023, includes proceeds from the general obligation bond sales. He further noted that the interfund loan payment for FY 2024 is significantly higher than in FY 2023, and it should be paid back sooner than anticipated. CEDD Mentzer clarified that residential developments take a few years to appear on property tax rolls and for the City to receive the tax revenues, as taxes are paid in arrears.

There was further discussion of the plan to use only TIF #4 funds to pay back the general obligation bonds. Mayor Brummel reiterated the fact that this debt should never appear on any property tax bills.

ALDERMAN WEIDNER MADE A MOTION, seconded by Ald. Lockett, to approve the inclusion of the decision packages in the FY 2024 Budget as presented.

ROLL CALL VOTE:

Aye: Aldermen: Aschauer, Barry, Davolos, Goodman, Krischel, Kruckenberg, Lockett, and Weidner

Nay: None MOTION CARRIED

3. Discussion of major initiatives

CA White concluded by stating the City is in an overall good financial position. Challenges will be monitored, and staff will continue to present recommendations to the Council to meet those challenges.

D. PUBLIC COMMENT

Maury Goodman asked what the split is between residential and non-residential users of water and sewer utilities. FD Dahlstrand replied that staff would have to look into that and report back at a later time.

Mayor Brummel recognized the significant contributions of two retiring aldermen and one retiring member of the senior staff.

He also recognized the City's bond rating of AA+. FD Dahlstrand added that the City did not meet the highest bond rating, partially because the City has not issued bonds in a very long time. The City could not start out at the highest rating.

Mayor stated this exercise is what he likes most about being Mayor, and added that it is very gratifying to be able to work with professional staff and informed elected officials.

Ald. Goodman recognized FD Dahlstrand for the work he put into preparing the budget while short staffed.

E. ADJOURN

ALDERMAN LOCKETT MADE A MOTION, seconded by Alderman Krischel to adjourn.

MOTION CARRIED VIA VOICE VOTE

https://www.warrenville.il.us/AgendaCenter/ViewFile/Minutes/_03182023-1219

Alerts Sign-up

Alerts Sign-up