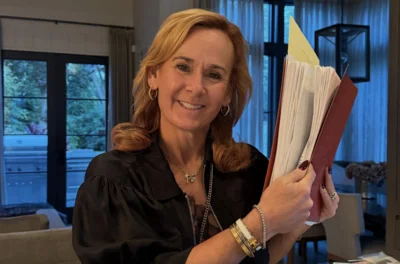

Illinois state Rep. Amy Grant (R-Wheaton) | File photo

Illinois state Rep. Amy Grant (R-Wheaton) | File photo

An Illinois state representative from DuPage County disagrees with the so-called “fair tax” proposal that would replace the state’s current flat income tax if approved by voters in November.

“The fair tax is a very bad idea and there are numerous reasons why it's a bad idea,” Rep. Amy Grant (R-Wheaton) told the DuPage Policy Journal. “The first reason is it allows legislators to fool around with the state income tax numbers anytime they want. Another reason is if low-income people think they are getting a break, they're really not because the tax code says that on $0 to $30,000 of income earned, instead of paying 4.9%, they'll be paying 4.75%. I hardly call that a break for lower-income earners.”

Grant shared her thoughts this week at a digital town hall hosted by Americans for Prosperity (AFP) Action, along with state Rep. Deanne Mazzochi (R-Elmhurst) and former state Rep. Peter Breen (R-Lombard), who is currently running to regain his seat in the 48th District.

House candidate Peter Breen (R-Lombard)

| File photo

“For the majority of my constituents, the fair tax will hurt them because I live in a town where there are million-dollar homes and multi-million dollar homes,” Grant said. “People have those homes because they have high incomes and it's going to affect them very badly.”

Both chambers of the Illinois General Assembly passed the Joint Resolution Constitutional Amendment No. 1 last year, allowing the proposal to be placed on the Nov. 3 ballot.

“The legislators spend more money than they have,” Grant said. “They won't address the automatic 3% COLA (cost-of-living allowance) increase for government workers. They vote on the other side of the aisle to give themselves a 3% automatic COLA increase. What would make anyone think they can trust them?”

Illinois' Democratic Gov. J.B. Pritzker has said he introduced the fair tax, also known as a graduated or progressive tax rate, as a means to ease the burden on middle-class families because it would earn the state $3.4 billion in added revenue, as previously reported.

“Gov. Pritzker is a rich man who has never known the hardship of anything, nor does he even care,” Grant said. “But there are wealthy people who do care.”

The Vote Yes for Fairness campaign, which Gov. Pritzker is allegedly funding with his own money, argues that the current tax system is broken and forces middle-class workers to pay the same tax rate as wealthier Illinois residents.

Alerts Sign-up

Alerts Sign-up