Issued the following announcement on July 28.

Schools continue to announce virtual learning schedules, the cancelation of elementary school sports and the delay of high school sports. As we head into an unprecedented school year, Jeanne Ives, a candidate for Congress in Illinois 6th Congressional District, has proposed a tax policy that would help provide families with additional resources to support their children in this new education model.

Ives’ first option is to increase the state property tax credit from 5% to 25% until schools are fully opened. “Parents need to supplement with tutors, supplies, enhanced technology, better internet, caregivers, enrichment courses and more,” said Ives. “We already have the property tax credit in law. All it takes to increase the credit is a simple one line bill. State legislators should jump on this ASAP – especially after they failed to enact any significant property tax relief last year.”

Alternatively, the state could increase the education tax credit from $750 per child to $2500 per child, and expand what expenses qualify for the credit. This option could be used for parents who do not qualify for a property tax credit.

The enhanced education tax credit is not a new idea. In 2016, Ives proposed a similar plan, which received bi-partisan support. Her legislation was ultimately killed by Speaker Madigan and special interests. Ives noted that families were increasingly having to supplement their children’s education four years ago. This need is even more urgent now in light of the sudden shift in our education model.

“There can be no debate about the increased costs to families of having children out of school,” Ives said. “Ultimately, this is about fairness. It is not fair to put the additional costs of off-campus learning on parents with no support from the state. This could be considered a qualified expense resulting from COVID.

“If the state budget is impacted by this additional credit, the cost should qualify for federal CARES Act funding as an expense incurred during the COVID Crisis.

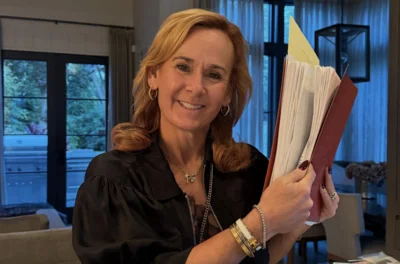

“Let’s be clear, it is the State of Illinois – with IDPH and ISBE – who have created liabilities for local districts reopening, as state orders cannot be easily ignored. I stood up for parents as a state legislator. I am a mom. I know that most suburban families were already hiring tutors, purchasing technology and extra training in everything from ACT Prep to basketball just so their kids could compete. It is a good thing to invest in students. And now – more than ever – parents are feeling the pinch of providing all that their kids need to thrive. If the state cuts off a significant amount of the resources their students would normally receive, it is only fair that the state provides families with some sort of direct support.”

Original source can be found here.

Alerts Sign-up

Alerts Sign-up