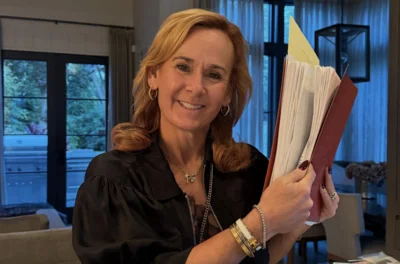

Illinois Senate Republican leader Christine Radogno is at the heart of a bold new plan aimed at ending the state’s two-year budget stalemate, which includes income and corporate tax hikes and billions more in added borrowing.

The way Radogno and Democratic Senate President John Cullerton see it, desperate times call for desperate measures, and with the largely bipartisan gridlock showing little signs of abating otherwise, the two see few options other than an everything-on-the-table compromise that could culminate in a full Senate vote over the next several days.

From there, Senate leaders are hoping House reps will join them in support of what they deem to be best for the overall health of the state.

Radogno’s willingness to embrace a plan that could include such massive tax increases is a far cry from the typical, cut-spending Republican way of doing things -- and that hasn’t gone across well with many of her GOP colleagues.

“I am offended and insulted by this effort to raise taxes even higher,” Republican Sen. Kyle McCarter told the DuPage Policy Standard. “We tried this years ago and hundreds of thousands of taxpayers left Illinois. The problem is people on both sides of the aisle are getting very creative on how they can tax people more instead of making tough choices and doing what it takes to end big government.”

Even if the Senate were to gain approval for its proposed tax increases, additional borrowing of at least $7 billion and changes to legalized gambling and workers’ compensation guidelines, there is no guarantee the House will go along in passing such legislation.

Indeed, the gridlock in Springfield has grown to be that unflappable, not to mention the partisan politics of the House led by Democratic Speaker Michael Madigan.

That’s part of the reason why Radogno and Cullerton insist they began crystallizing their plan without including House members or Gov. Bruce Rauner in the initial discussions.

Throughout their two-year face-off, Rauner has insisted that including changes to lower workers’ compensation costs -- as well as language to weaken unions and lower property taxes -- be part of any compromise, all measures that Madigan has rejected as nonstarters for the purposes of balancing the state’s budget.

Radogno later told the Chicago Tribune she expected much of the jostling and back and forth by the two sides to continue, but added she remains optimistic about what could be if everyone pulls together.

As time moved on, that guarded optimism seemed to wane a bit amid reports that a marathon session of legislative hearings had yielded little progress and the complex package of tax increases and favorable business considerations showed signs of crumbling under its own weight.

By late Tuesday, House reps had canceled some sessions to head home earlier than what was expected in anticipation of Rauner’s scheduled State of the State Address.

Before departing, lawmakers from both sides huddled in closed-door meetings, presumably plotting their next moves.

On the burning question of how Radogno is now viewed among party members in Springfield, McCarter didn’t mince words.

“I think this is a very misguided effort,” he said. “I don’t believe it supports the principles or policies of my party. I can’t see how anyone that is against big government can support this. I hope the citizens of the state will speak up. This needs to be a net win for taxpayers, a plan that gives more reforms and lowers tax rates.”

Alerts Sign-up

Alerts Sign-up